Invest in the Company Ending Real Estate Commissions

Homeowners are tired of paying realtors 6% in fees just to list their homes. So we are creating an AI powered platform that removes the middleman:

- Sellers save an average of $20k+ in commissions

- Attracted $180 million in listings in 90 days

- Joining 350+ MLS partnerships across 44 states (nationwide by year’s end)

Now’s your chance to share in our growth as an early-stage investor.

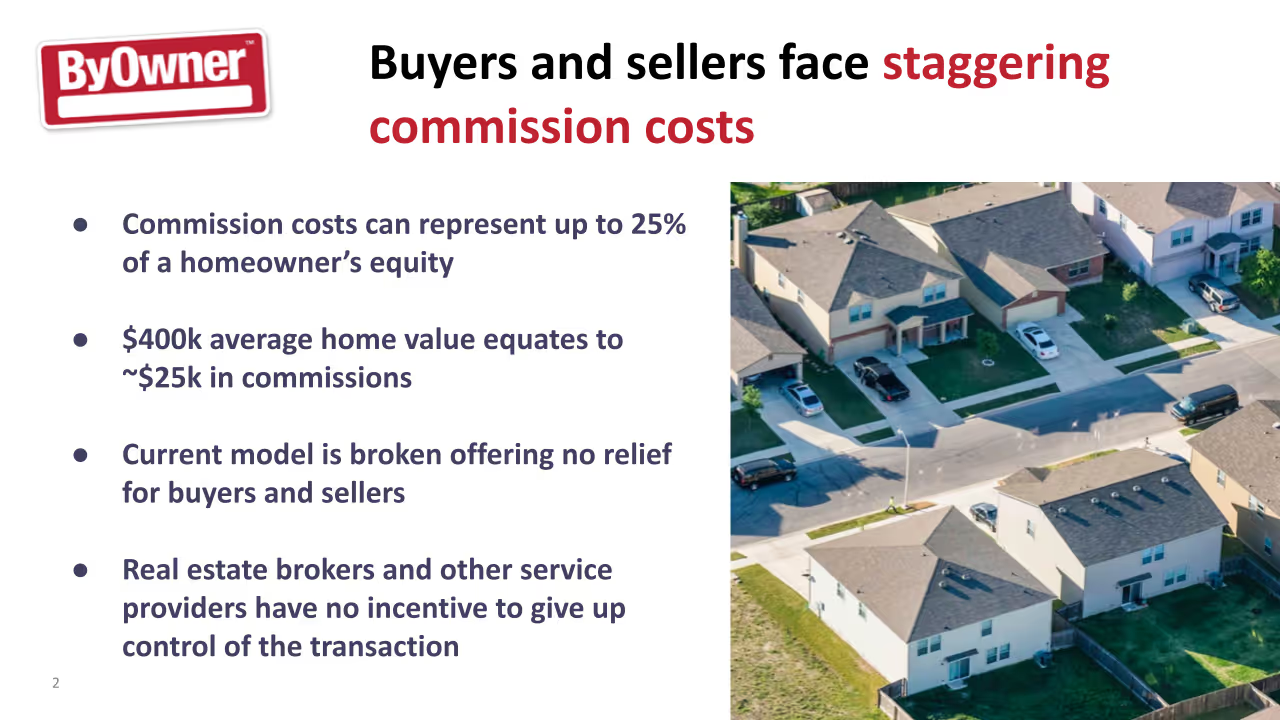

The 6% Fee Costing Americans $100B/Year

Last year, Americans sold 4M+ homes, losing over $100B1

in equity to real estate commissions. After the mortgage is paid, these fees eat up to 6% of owners’ hard-earned equity. In this tech-forward market, agents primarily connect buyers and sellers. So why should they collect a huge cut? That’s why we modernized the model.

Using Tech to End Commissions

For one low price, we offer the same end-to-end support, but we redesign it to give owners back control (and money). Whether you’re a buyer, seller, or business, ByOwner makes real estate work for you with:

$180M in Homes in Just 90 Days

With proven success, powerful real estate data, and high-quality networks in place, we’re already on our way to mass adoption.

$180M

Homes listed and 10,000+ quality leads generated in 90 days

350+ partnerships

Currently onboarding 350+ MLS partnerships

44

Licensed in 44 states (nationwide by year’s end)

Big Retailers

We’re actively in negotiations with several nationwide major big-box retailers.

Diversified Revenue That Doesn’t Prey on Owners

We save sellers thousands, but our model is also designed for strong margins and growth. While the flat fee lists the property, sellers often choose mortgage, title, and insurance services through our network, generating revenue through strategic partnerships. Then big-box retailers promote ByOwner.com to their customers, boosting brand awareness and generating new leads. It’s a diversified model built to grow with each transaction.

From Big-Box Retailers to AI/ML Systems

ByOwner.com’s next phase is about scaling efficiently and intelligently.

Expand retail marketing partnerships

with retailers like Lowe’s, Sam’s Club, and more

Train AI/ML systems

from collected data to personalized marketing, predictive homeowner action, and more effective buyer and seller connections

Deepen platform capabilities

including integrated mortgage, title, and insurance services

Increase marketing efforts,

where early results show a 3.8X return on ad spend

Similar companies with substantially fewer data streams and leads have recently sold for billions:

in a deal scheduled to close in 2025.

in 2015.

for a reportedly substantial price

Get your investor deck

Stands Out

Like others, we’re a fully licensed national brokerage. But our flat-fee model saves sellers up to 95% in commissions while giving them control over the process, whether they want a basic MLS listing or full-service support. Our real-time data on every listing and lead fuels AI-driven marketing and a powerful B2B engine. And unlike others, we monetize across brokerage, mortgage, title, insurance, and retail partnerships, creating diversified revenue streams.

Early Investors Get More Stock

As a thank you to our earliest supporters, we’re offering special bonus shares. The more you invest, the bigger your bonus and the more perks you unlock.

Made up of proven founders and leaders, including the man behind ForSaleByOwner.com.com’s $65M acquisition, the ByOwner.com team is carefully crafted and composed of real estate and business innovators.

.jpg)

Frequently Asked Questions

Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise - you are buying a piece of a company and helping it grow.

How much can I invest?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest.

What do I need to know about early-stage investing? Are these investments risky?

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

When will I get my investment back?

The Common Stock (the "Shares") of ByOwner.Com (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Can I sell my shares?

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

• The company that issued the securities;

• An accredited investor;

• A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships).

What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

How can I learn more about a company's offering?

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on its website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

What relationship does the company have with DealMaker Securities?

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

.avif)

.avif)

.avif)

.avif)